History shows us that sticking with your long-term investment plan can be the key to success.

But the emotional swirl of short-term market movements can often make us feel less confident as investors.

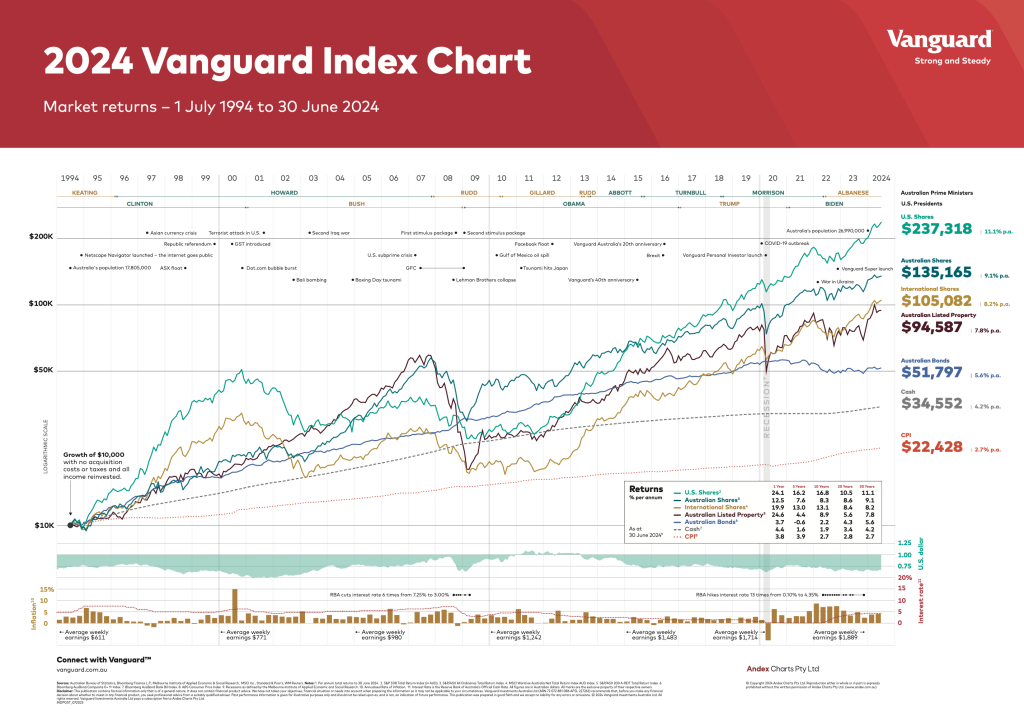

To help you stay focused on your goals, I’d like to share the 2024 Vanguard Index Chart, which shows the long-term performance of different asset classes over the past 30 years, through to 30 June 2024. The table at the bottom right of this chart shows 1,5,10,20 and 30 year returns for each individual asset class, plus inflation (CPI).

The chart shows that, despite the noise and short-term market swings, asset values have steadily increased over the long term. I encourage you to take a look and see for yourself.

Three tips for a brighter financial future

We can’t control how markets behave. But by understanding the importance of regular investments, diversification, and the need to stay the course, we can stay in control of our investment plan. Here are three tips to help.

Time in the market, not timing the market

Reacting emotionally to short-term market movements rarely serves us well. Don’t be swayed by the day-to-day movements of share markets into making knee-jerk investment decisions.

Set up a steady investing strategy

Making regular investments into your portfolio is a proven strategy to boost long-term returns. If you would like to set up regular automated investments, please reach out. If you want to see the power of compounding returns, link below to a calculator – just add in initial investment, regular contribution amount and frequency plus the assumed rate of return and timeframe. https://moneysmart.gov.au/budgeting/compound-interest-calculator

Diversify to stay strong through market volatility

Diversification reduces risk and generates strong and steadyreturns. If you’re not sure where to start, contact us and we can help build a diversified portfolio to suit your risk profile.