Economic Update – Monetary policy / Interest rates and Inflation

The Reserve Bank of Australia (RBA) is in the headlines – everyone wants to know why things seem so tough. Interest rates are up, property values are down, and everything seems more expensive.

The RBA sets Australia’s monetary policy, which is done by either decreasing or increasing interest rates. The RBA has three main goals:

- Keep inflation low and stable – with an aim of having inflation running somewhere between 2% to 3%,

- Maintain full employment, and

- Promote economic prosperity for the population of Australia.

Here is a 4-minute YouTube clip if you want a easy to understand crash course in monetary policy:

The update below aims to outline what is happening (and why).

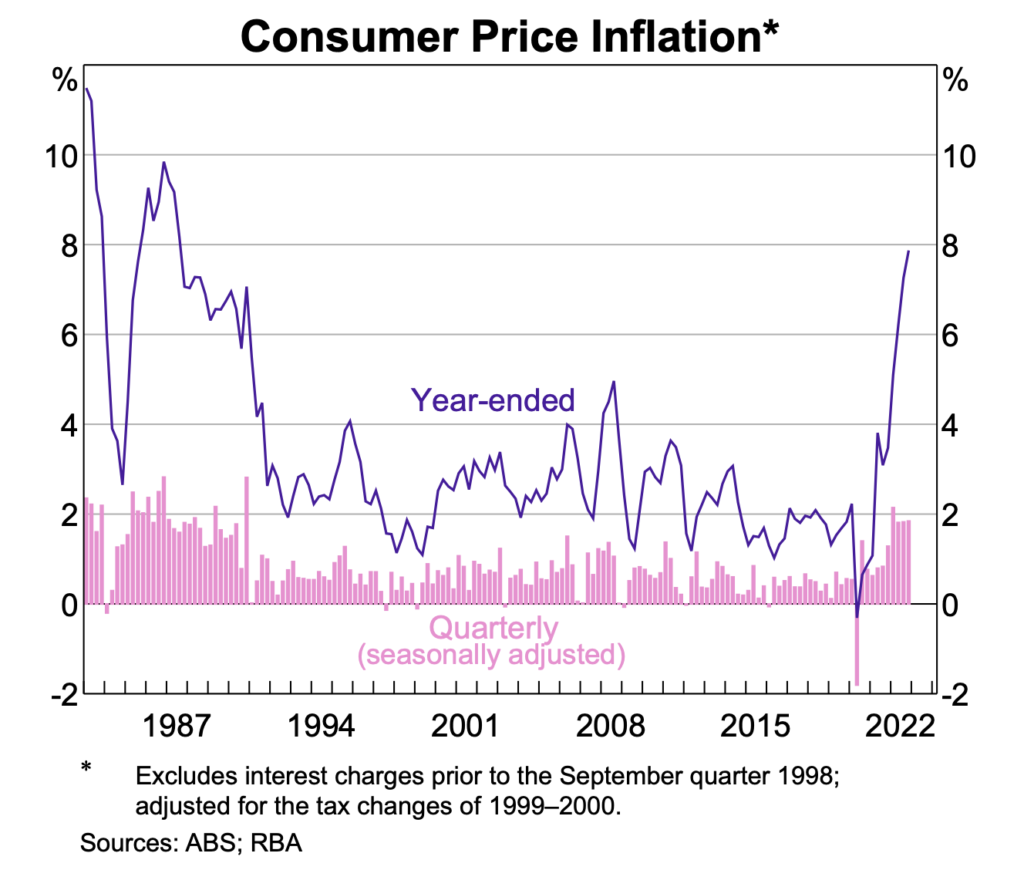

| Currently, inflation is very high – it hasn’t been this high since the late 1980’s – as shown in the graph below. |

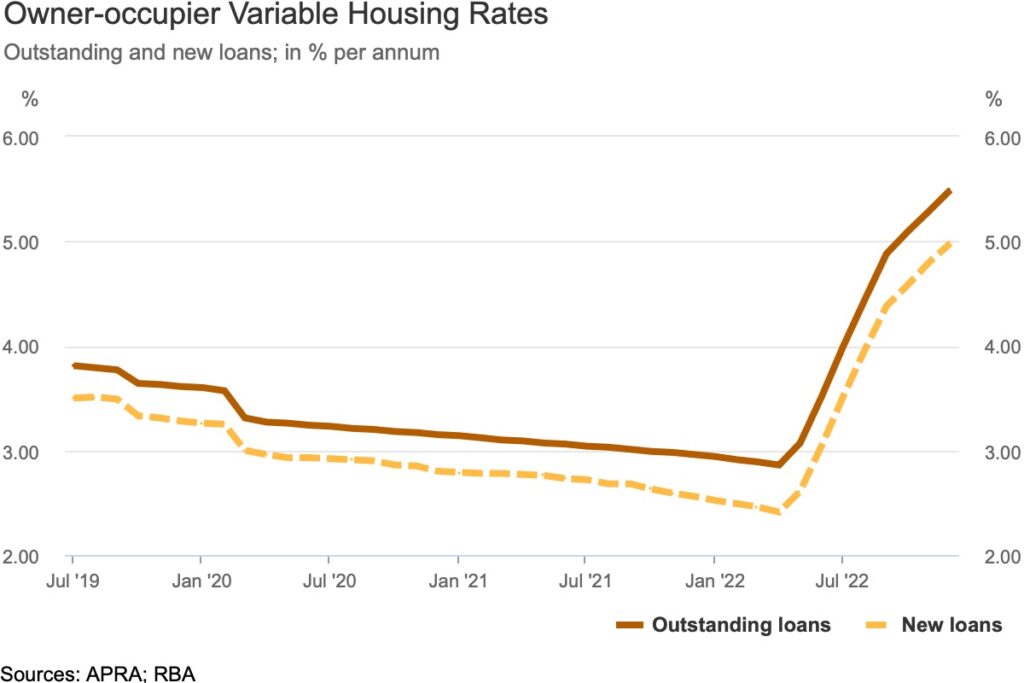

| So, the RBA has had to start increasing interest rates, and has done so at a record pace. Home loan borrowing rates for new home loans have doubled from 2.50% to 5.0% in the last 10 months. |

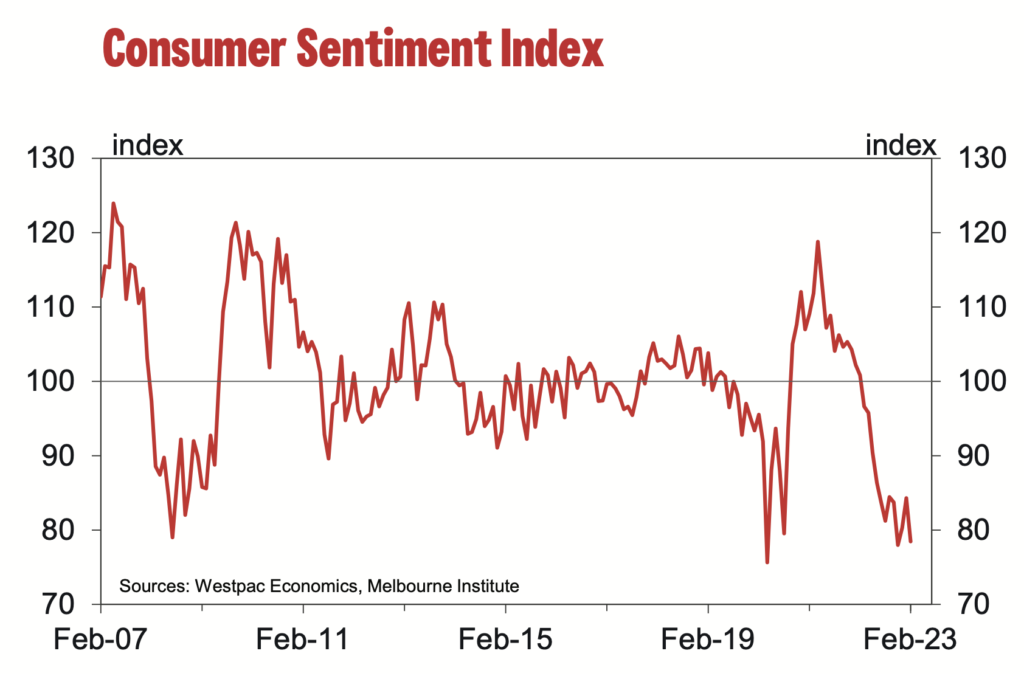

| High inflation and increasing interest rates lead to lower consumer confidence. The Westpac Consumer sentiment report from last week shows consumer confidence is as low now as it was during the start of the Covid Pandemic in 2020, or during the GFC in 2008. |

| The broad advice I give my clients in times like these is outlined as follows: |

- A good quality asset (regardless of if it is a property or a share portfolio) will recover in price, as long as you are not a forced seller. A change in the value of an asset is just that – a change. It is only when you need to sell that you crystallise any price falls.

- Have a cash buffer to ride out any short term cashflow issues, but remember with inflation running at 8% – and the current cash rate is 3.35% – holding too much cash (even if it feels safe in the short term) means the purchasing power of any large cash reserves will be reducing over time.

- Factor in higher interest rates to any borrowing decision you make – and how higher loan costs may impact your budget.

- Review your personal budget. If you don’t budget, then now is an excellent time to begin. If you need some assistance on budgeting visit: How to do a budget – Moneysmart.gov.au

- Don’t ignore risk management – maintain insurance on your home or investment properties and insurance on yourself. If you were to prematurely die, you don’t want your loved ones to be forced sellers. If you can’t work or suffer an unexpected medical event, having a personal risk management plan in place provides peace of mind when it is needed most.

- Stay diversified with your growth assets, a mix of property and shares will be less risky than having all your eggs in the one basket. Both shares and property can go up, and down in value – and this can often occur at different times.

As always, if you have queries or wish to discuss your specific financial situation, please get in touch, or book in a meeting / call time with me via the following link: