In these times of heightened market volatility, I want to provide you with a comprehensive October market update that aims to put recent fluctuations in investment markets into context. Alongside this, I’ve compiled some valuable tips to help you reduce costs and minimise financial worries.

Global Markets and Geopolitical Risks

Geopolitical risks are a sobering reality in our interconnected world. These risks arise from interactions between various countries, often resulting in conflicts that can impact financial stability. Recent events such as the unrest in the Middle East, the ongoing Russia -Ukraine conflict, and the strained China-U.S. relationship have elevated these geopolitical risks. These developments not only shape global affairs but also impact investment markets and portfolio returns.

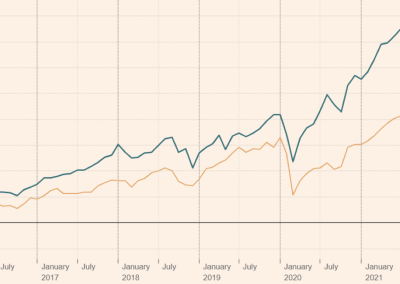

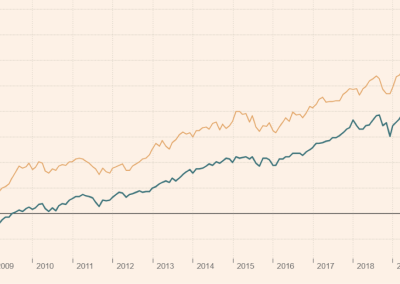

Considering these developments, it’s only natural to have concerns, though it is crucial to remember that the global financial landscape is remarkably resilient and adaptable. In this context, I would like to share the following graphs, illustrating how significant market fluctuations over shorter timeframes tend to stabilise when measured over longer periods.

The graphs below outline the 1, 5, 10 and 20 year returns of the:

- Australian share market (measured by the ASX200 index – orange line)

- US share market (measured by the S&P 500 index – green line)

Building Financial Resilience

During times of uncertainty, it’s always prudent to consider strategies that can help. Here are some valuable tips tailored to various aspects of your financial well-being:

For Those with a Mortgage:

If you have a mortgage, it’s worth exploring options to potentially reduce your interest rate. Contact your bank and mention that you’re reviewing your mortgage choices and even considering offers from competitors. If you don’t find a more favourable rate through your bank, consult a mortgage broker to evaluate your current loan and compare the market. Keep in mind that refinancing might involve upfront costs. To assist you in your decision-making, you can use the mortgage switching calculator provided by the government’s MoneySmart website here:

https://moneysmart.gov.au/home-loans/mortgage-switching-calculator

Private Health Insurance Review:

If you have private health insurance, it’s wise to review your policy. Ensure it aligns with your actual needs, and consider the extras you’re paying for. Also, explore whether other providers offer better deals. Before switching policies, be cautious about potential changes to waiting periods, new limits, or loss of loyalty bonuses. Many so-called “comparison sites” may primarily sell new policies and offer a limited selection of policies for comparison. To genuinely compare all available health policies, visit the Private Health Ombudsman’s comparison website here:

https://privatehealth.gov.au/dynamic/search/start

NSW Government Savings Finder Website

The NSW Government provides various rebates and discounts to residents – covering a wide variety of services and areas. The savings finder tool outlines the discounts that may be available, which are dependent on your individual circumstances. Follow the link to check out what savings may be available to you.

https://www.service.nsw.gov.au/campaign/savings-finder

For Adult Children with Debts or Mortgages:

For those whose age or financial situation doesn’t necessitate life insurance, it’s important to ensure that your adult children have this area addressed, particularly personal risk insurance (Life, TPD, Trauma, and Income Protection). In cases where an adult child isn’t adequately covered and faces an insurable event, the financial responsibility often falls on the parents. Insurance coverage can often be held or paid for through superannuation to minimise cashflow impacts. However, it’s essential to note that some default insurance cover offered by superannuation funds can be high in cost and low in features.

I’m here to offer support to your family members in this regard and would be pleased to speak with any of them. Please feel free to connect them with me, and I’ll provide the guidance they need. You can also use the life insurance calculator provided by the government’s MoneySmart website here:

https://moneysmart.gov.au/how-life-insurance-works/life-insurance-calculator

Estate Planning:

If you haven’t established Wills and enduring Powers of Attorney, not only can this result in extra costs and hassles for your loved ones in the event of your passing, but for those with complex family situations or young children, it can lead to substantial financial repercussions. Should you need assistance in this area, I can connect you with experienced lawyers who can handle both straightforward and intricate estate planning matters.

Reviewing Your Spending:

To gain better control of your finances, consider tracking your spending and budgeting. Review your bank and credit card statements. The government’s MoneySmart website offers an excellent Excel spreadsheet for personal budgeting, which you can download here:

https://moneysmart.gov.au/budgeting/budget-planner

Taking steps to address these aspects of your financial well-being can provide you with greater peace of mind during these uncertain times. If you have any questions or need assistance with any of these areas, please don’t hesitate to reach out. If you wish to discuss anything further please call me directly, or in book in a time to chat via my website.