Now that the end of financial year is behind us, it is time to shift focus from strategies relating to the management of taxation outcomes and superannuation and begin to look ahead, with some superannuation contribution rules changing from today (1 July 2022). These changes could create new opportunities which may benefit you.

The key changes from 1 July 2022 include:

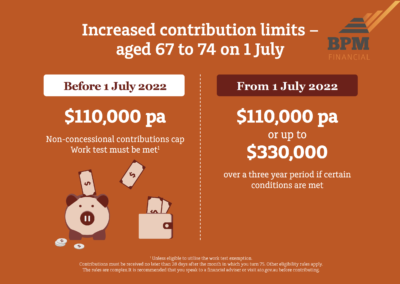

- increasing the amount of personal contributions that can be made to superannuation for people aged 67-74*

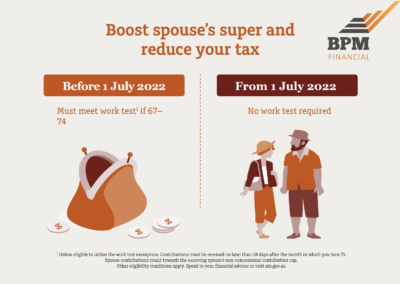

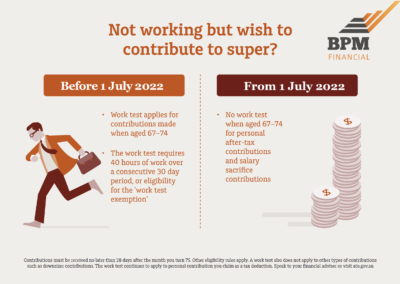

- removing the requirement to satisfy a work test before making personal after-tax contributions and salary sacrifice contributions for those 67 to 74*

- reducing the eligibility age for making a downsizer contribution from 65 to 60

- increasing the amount that can be released under the First Home Super Saver Scheme to use to purchase a first home, and

- removing the minimum monthly income threshold before an employer is required to pay Superannuation Guarantee on behalf of employees.

* Contributions must be received no later than 28 days after the month in which the person turns age 75.

These opportunities have a range of eligibility requirements so don’t hesitate to contact me to discuss how these changes impact your circumstances and opportunities that may exist for you.